Best Expense Tracker Articles

It's common trend today to have a side hustle that brings in some extra cash. Most people don't rely on a single income. Fortunately, there are many ways you can make money on the side, including pet sitting or dog walking.

Without a budget, you’re gambling with the certainty of your financial future. You risk getting into major debt and stressing yourself out unnecessarily. Every dollar unaccounted for puts you one step closer to financial chaos.

The best debt payoff plan allows you to make more than the minimum amount due on each debt. If your regular salary doesn't allow enough room for this, consider learning how to make extra money to pay off debt.

If the holiday season has you feeling a bit overwhelmed, you aren't alone. Between celebrations, gifts, and decorating, everyone is under a ton of pressure, and it can feel impossible to keep a budget.

Every savings goal is unique, requiring specific types of accounts, savings amounts, and investment strategies. Short-term goals often call for more conservative approaches, while long-term goals allow for more time and potentially higher-risk strategies.

Saving money quickly on a low income might feel daunting at first, but living paycheck-to-paycheck doesn't make it impossible. By taking the right steps, you can discover effective strategies for budgeting and saving, regardless of how limited your income may be.

Discover the top 10 reasons why you can't save any money and get actionable advice to finally start building savings. Managing your budget can be challenging, especially with increasing prices today. Even if you don't live paycheck-to-paycheck, you may find that you cannot save money.

Managing a family budget can be challenging, especially with the myriad of expenses that arise on a daily basis. In today's fast-paced world, it is crucial for families to track their expenses diligently.

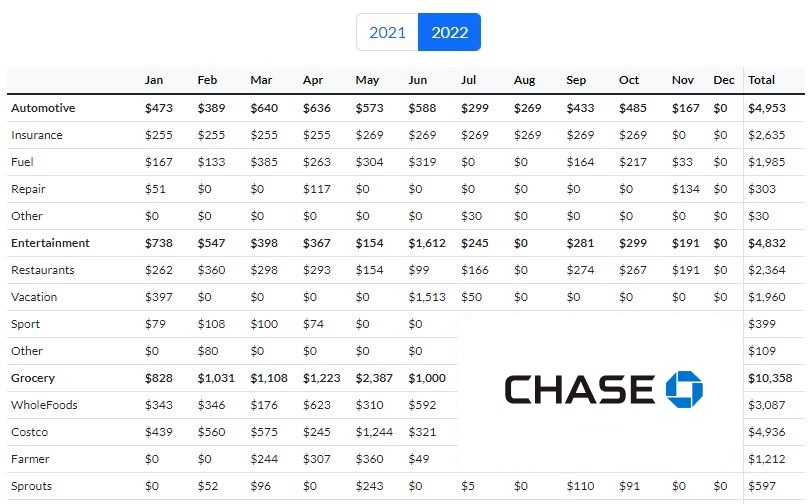

Make sure you know how to export all your transactions from your Chase credit card into our system. Login to your Chase account and import cards' transactions and to track your expenses.

Following these easy steps you can export transactions from your Bank of America account into our system. You can import credit and debit cards transactions and track your expenses easily.

Copyright © 2024 Spendings.IO. All rights reserved.